“Insurance Insights: Expertise and Knowledgeable Staff in Canada and the USA”

### Introduction

1. **Introduction to Insurance**

– Importance of insurance in personal and business risk management.

– Overview of the insurance industry in North America.

### Section 1: Types of Insurance

2. **Life Insurance**

– Overview of life insurance policies and coverage options.

– Importance of life insurance in financial planning.

3. **Health Insurance**

– Types of health insurance plans (e.g., individual, group, Medicare).

– Coverage benefits and considerations.

4. **Property and Casualty Insurance**

– Overview of property insurance (e.g., homeowners, renters) and casualty insurance.

– Coverage options and claims process.

5. **Auto Insurance**

– Types of auto insurance coverage (e.g., liability, comprehensive, collision).

– Factors influencing auto insurance premiums.

### Section 2: Roles of Insurance Professionals

6. **Insurance Agents and Brokers**

– Responsibilities of insurance agents and brokers.

– Differences between captive and independent agents.

7. **Underwriters**

– Role of underwriters in assessing risk and determining premiums.

– Skills and qualifications required for underwriting.

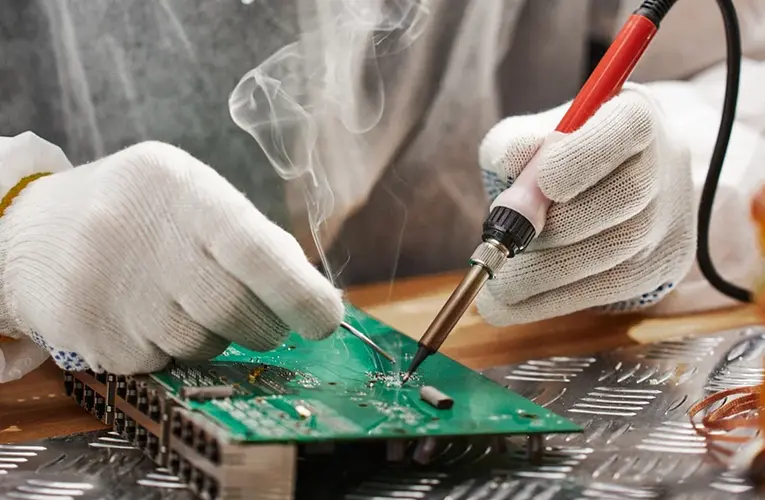

8. **Claims Adjusters**

– Responsibilities of claims adjusters in processing insurance claims.

– Importance of effective claims handling.

### Section 3: Industry Trends and Innovations

9. **Technological Advancements**

– Impact of technology on the insurance industry (e.g., AI, blockchain).

– Use of digital platforms for policy management and claims processing.

10. **Customer Experience**

– Trends in customer service and client relationship management.

– Importance of personalized insurance solutions.

11. **Data Analytics and Risk Management**

– Role of data analytics in insurance pricing and risk assessment.

– Innovations in predictive modeling and risk mitigation.

### Section 4: Regulatory Framework and Compliance

12. **Regulatory Agencies**

– Overview of insurance regulators in Canada and the USA.

– Compliance requirements for insurance companies and professionals.

13. **Consumer Protection**

– Rights and protections for insurance policyholders.

– Legal considerations in insurance contracts and disputes.

### Section 5: Expert Insights and Industry Perspectives

14. **Interviews with Insurance Professionals**

– Insights from industry experts on current challenges and opportunities.

– Career advice for aspiring insurance professionals.

### Section 6: Comparative Analysis: Canada vs. USA

15. **Comparison of Insurance Markets**

– Differences in insurance regulations and market dynamics.

– Consumer behaviors and preferences in insurance purchasing.

### Section 7: Future Directions in Insurance

16. **Emerging Trends**

– Predictions for the future of the insurance industry.

– Innovations in product development and distribution channels.

### Conclusion

17. **Final Thoughts on Insurance Insights**

– Recap of key insights into insurance expertise and knowledgeable staff.

– Recommendations for consumers and industry professionals.

### Appendices (Optional)

– **Glossary of Insurance Terms**

– **List of Regulatory Agencies in Canada and the USA**

– **FAQs about Insurance**